Winners in other locations could pay as much as 10.75% in state or local taxes, according to USA Mega. Fourteen states don’t levy additional tax on lottery winnings: Alabama, Alaska, California, Delaware, Florida, Hawaii, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Utah, Washington, and Wyoming. The winner-or winners-will owe 24% to the IRS in federal taxes, and then additional taxes when they file (winning that much money will put you in the top federal tax bracket). If there’s a winner who chooses the lump sum option, they could take home roughly $929.1 million, the second-highest cash prize ever. Most financial experts advise winners take the lump sum, and that’s what most winners opt to do. Winners can choose to receive a one-time lump sum payment or an annuity, with the prize being paid out over 30 years. You can win in Double Play and Powerball with the same numbers. That helped the jackpot climb from $1.9 billion to over $2 billion. The odds are the same as Powerball because the numbers are drawn from the same range. Virgin Islands.The Powerball figures were drawn Tuesday morning after a nearly 10-hour delay.

Please note, the amounts shown are very close. The table below shows the payout schedule for a jackpot of 440,000,000 for a ticket purchased in New York, including taxes withheld.

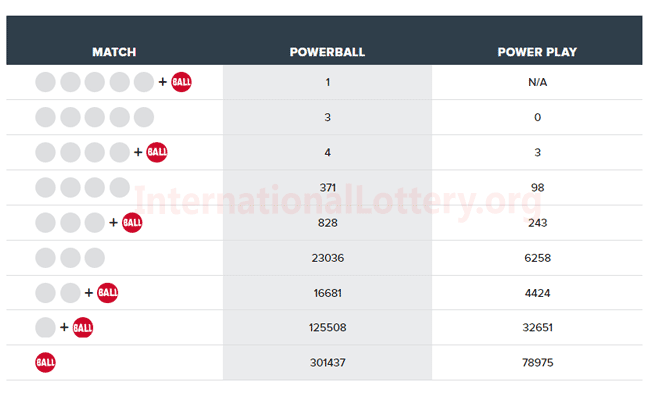

Powerball is played in 45 states, as well as Washington, D.C., Puerto Rico and the U.S. The Powerball annuity jackpot is awarded according to an annually-increasing rate schedule, which increases the amount of the annuity payment every year. “That investment adviser will get fees off managing that money.”Ĭhancey said talented investors probably could make more money than paid through an annuity but there is risk and advisers need to be open about their potential gain depending on the jackpot winners’ choices. “If you go to a financial person and say you want to invest $1 billion, the financial person will say take the $600 million and we’ll pay taxes on it, you’ll have $300 million left over and I’ll invest it for you,” Chancey said. But Chancey also urged winners to understand that if advisers earn a percentage from the investment of all that money, they have a financial stake in how the money is paid out and should be clear about any potential conflict. For an additional stake, the Power Play increases any non-jackpot prizes won by up to 10 times their original value. Matt Chancey, an investment adviser in Tampa, Florida, said that certainly makes sense. 1 in 913,129 1 in 36,525 1 in 14,494 Overall chances of winning: 1 in 24.9 The Power Play is an add-on that you can opt in to when you enter Powerball. Officials urge anyone lucky enough to win a Powerball jackpot to consult a financial adviser - while keeping that valuable ticket safe - before showing up at a lottery office for an oversized check. If no one wins Wednesday night, the jackpot could become the largest ever, topping a $1.586 billion Powerball prize won by three ticket holders in 2016. 3 - resulting in 38 consecutive draws without a jackpot winner.Īll that losing has let the Powerball jackpot grow to be the fourth-largest in U.S.

That’s why no one has won Powerball’s top prize since Aug. Of course, it’s good to keep in mind that your chance of winning the jackpot is incredibly small, at 1 in 292.2 million.

“And I’d rather get all my good deeds done right away and feel good about the giving,” Thomas said, adding she would donate to groups that do medical research for children as well as help veterans, homeless people and animals. While purchasing five Powerball tickets at a Speedway gas station in Minneapolis, 58-year-old Teri Thomas said she’d rather take the cash prize because she doesn’t think she’ll live long enough to collect an annuity over 29 years.

#POWERBALL PAYOUT FULL#

“If you think you can beat the 4.3%, you should take the cash,” Keil said. There are two payout options to choose between: The full jackpot amount spread out over 30 years as an annual payment, or a lesser amount of 934.8 million as an upfront lump sum payment.

0 kommentar(er)

0 kommentar(er)